we will begin mailing this proxy statement.YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE SUBMIT A PROXY AS PROMPTLY AS POSSIBLE BY USING THE INTERNET OR THE DESIGNATED TOLL-FREE TELEPHONE NUMBER, OR BY SIGNING, DATING AND RETURNING BY MAIL THE PROXY CARDIN THE RETURN ENVELOPE PROVIDED.

| | Sincerely yours, | By order of the Board of Directors, |

| | |

| | /s/ Paul M. Galvin |

| | Paul M. Galvin |

| | PAUL M. GALVIN | |

| CEOChairman, Chief Executive Officer and Chairman of the Board | Chief Operating Officer |

195 Montague Street, 14th Floor

Brooklyn, New York New York

[June 16], 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF 11201PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON [JULY 15,] 2014.

This NoticeSTATEMENTFor the Special Meeting of Annual Meeting and Proxy Statement along with theStockholders to be held on ____________

GENERAL INFORMATION

We are providing these proxy materials to holders of shares of common stock, $0.01 par value per share, of SG Blocks, Inc. Annual Report on Form 10-K for, a Delaware corporation (referred to as “SG Blocks,” the year ended December 31, 2013, (without exhibits) are available on the Internet at: www.proxyvote.com.

SG BLOCKS, INC.

3 Columbus Circle

16th Floor

New York, New York 10019

(212) 520-6218

PROXY STATEMENT

Introduction

This proxy statement is furnished“Company,” “we,” or “us”), in connection with the solicitation by the Board of Directors

(the “Board”) of SG Blocks

Inc., a Delaware corporation (the

“Company”“Board” or “Board of Directors”) of proxies

in the accompanying form to be

usedvoted at

the Annualour 2019 Special Meeting of Stockholders

of the Company(the “2019 Special Meeting” or “Special Meeting”) to be held on

[July 15],

2014,beginning at 10:00 a.m., local time at the New York City office of Gracin & Marlow, LLP, Chrysler Building, 405 Lexington Avenue, 26thFloor, New York, New York 10174, and

at any adjournment or postponement

thereof (the “Meeting”). This proxy statement,of our 2019 Special Meeting.The purpose of the 2019 Special Meeting and the matters to be acted on are stated in the accompanying formNotice of proxy, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 (the “2013 Annual Report”) (without exhibits), is being mailed to stockholders on or about [June 16], 2014. The shares represented by the proxies received pursuant to the solicitation made hereby and not revoked will be voted at theSpecial Meeting.

Meeting of Stockholders

The Meeting will be held at the offices of Olshan Frome Wolosky LLP, 65 East 55th Street, New York, New York 10022 on [July 15], 2014, at 10:00 A.M., Eastern Time.

Record Date and Voting

The Board

has fixedof Directors knows of no other business that will come before the

close2019 Special Meeting.The Board of business on [June 4]Directors is soliciting votes (1)FOR the approval of an amendment to our amended and restated certificate of incorporation, as amended (the “Restated Certificate of Incorporation”), 2014, as the record date (the “Record Date”) for the determinationto effect a reverse stock split of holders ofour issued and outstanding shares of common stock, at a ratio to be determined in the Company entitleddiscretion of the Board of Directors within a range of one (1) share of common stock for every two (2) to notice of and to vote on all matters presented at the Meeting. Such stockholders will be entitled to one vote for each share held on each matter submitted to a vote at the Meeting. You may vote in person at the Meeting or by proxy. On the Record Date, there were approximately 42,773,093fifty (50) shares of the Company’s common stock $0.01 par value per share (the “Common Stock”“Reverse Stock Split”), issued and outstanding, each of which is entitled to one vote on each mattersuch amendment to be voted upon.

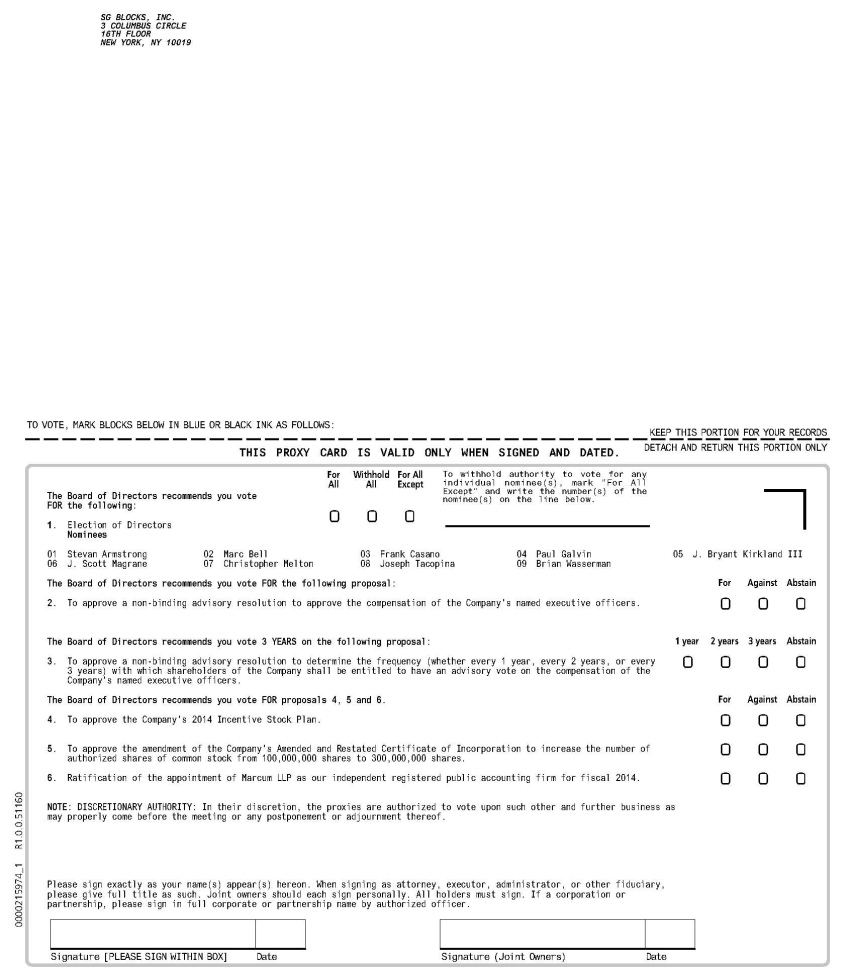

Purposeseffected after stockholder approval thereof only in the event the Board of the Meeting

The purposes of the Meeting are to vote upon: (1) the election of nine (9) directors to serve until the next annual meeting in 2014, or until their successors have been duly elected and qualified (Proposal 1),Directors still deems it advisable; (2) a non-binding advisory resolution to approve the compensation of the Company’s named executive officers, the proxy card gives you the ability to approve, or disapprove, or abstain from voting (Proposal 2), (3) a non-binding advisory resolution to determine the frequency with which stockholders of the Company shall be entitled to have an advisory vote on the compensation of the Company’s named executive officers, the proxy card gives you the ability to select every 1 year, every 2 years, every 3 years, or abstain from voting (Proposal 3), (4)FOR the approval of the Company's 2014 Incentive Stock Plan (Proposal 4), (5) thean amendment ofto the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 100,000,000 shares25,000,000 to 300,000,000 shares (Proposal 5) (6) the ratification of Marcum LLP as the Company’s independent accountants for the fiscal year ending December 31, 2014 (Proposal 6) and (7)50,000,000 (the “Authorized Common Stock Increase”), such other business as may properly come before the Meeting.

Quorum and Required Vote

Under the By-Laws of the Company, the presence of a quorum is required for each matteramendment to be acted upon at the Meeting. The presence, either in person or by properly executed proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum for the purpose of acting on the matters referred toeffected after stockholder approval thereof only in the Noticeevent the Board of AnnualDirectors still deems it advisable; and (3)FORapproval to adjourn the 2019 Special Meeting, of Stockholders accompanying this proxy statement and any other proposals that may properly come beforeif the Meeting. Except in connection with Proposal 5, as described in more detail below, Broker non-votes and abstentions willBoard determines it to be counted only for the purpose of determining whethernecessary or appropriate, if a quorum is present, at the Meeting. Broker non-votes occur when a broker returns a proxy but doesto solicit additional proxies if there are not have the authority to vote on particular proposals.

The director nominees receiving a pluralitysufficient votes in favor of any of the votes cast duringReverse Stock Split and the MeetingAuthorized Common Stock Increase (the “Adjournment”).SPECIAL MEETING ADMISSION

All stockholders as of the record date are welcome to attend the 2019 Special Meeting. If you attend, please note that you will be electedasked to fill the seats of the Board (Proposal 1). You may withhold votes from any or all nominees. Abstentions will not affect the outcome of the vote on Proposal 1.

The proposal to approve the non-binding advisory resolution approving the compensation of the Company’s named executive officers (Proposal 2), requires the affirmative (“FOR”) vote of the majority of the votes cast for approval, provided that the affirmative votes cast must represent a majority of the shares present in person or represented by proxy at the Meeting and entitled to vote. Abstentions will have the same effectgovernment-issued identification (such as a vote “AGAINST”driver’s license or passport) and evidence of your share ownership of our common stock on the proposal.

With respectrecord date. This can be your proxy card if you are a stockholder of record. If your shares are held beneficially in the name of a bank, broker or other holder of record and you plan to approvingattend the non-binding advisory resolution2019 Special Meeting, you will also be required to determinepresent proof of your ownership of our common stock on the frequency with which stockholders ofrecord date, such as a bank or brokerage account statement or voting instruction card, to be admitted to the Company2019 Special Meeting.No cameras, recording equipment or electronic devices will be entitledpermitted in the 2019 Special Meeting.

Information on how to have an advisory vote onobtain directions to attend the 2019 Special Meeting is available at:www.sgblocks.com.

INFORMATION ABOUT THE SPECIAL MEETING

| Q: | What information is contained in the proxy statement? |

| |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the 2019 Special Meeting, the voting process and other required information. |

| |

| Q: | How do I get electronic access to the proxy materials? |

| |

| A: | This proxy statement, theproxy card and the notice are available atwww.sgblocks.comorwww.astproxyportal.com/ast/21306. |

| |

| Q: | What items of business will be voted on at the 2019 Special Meeting? |

| |

| A: | The purpose of the 2019 Special Meeting and matters to be acted upon are as follows: (1) the approval of the Reverse Stock Split at a ratio to be determined in the discretion of the Board of Directors within a range of one (1) share of common stock for every two (2) to fifty (50) shares of common stock; (2) the approval of the Authorized Common Stock Increase to increase the number of authorized shares of common stock from 25,000,000 to 50,000,000; and (3) the approval of the Adjournment of the 2019 Special Meeting, if the Board of Directors determines it to be necessary or appropriate, to solicit additional proxies if there are insufficient votes in favor of any of the Reverse Stock Split and the Authorized Common Stock Increase. |

| |

| Q: | How does the Board of Directors recommend that I vote? |

| |

| A: | The Board of Directors recommends that you vote your shares (1)FOR the approval of the Reverse Stock Split at a ratio to be determined in the discretion of the Board of Directors within a range of one (1) share of common stock for every two (2) to fifty (50) shares of common stock; (2)FOR the approval of the Authorized Common Stock Increase; and (3)FORthe approval of the Adjournment of the 2019 Special Meeting, if the Board of Directors determines it to be necessary or appropriate. |

| |

| Q: | What shares can I vote? |

| |

| A: | You may vote or cause to be voted all shares owned by you as of the close of business on November 18, 2019, the record date. These shares include: (1) shares held directly in your name as a stockholder of record; and (2) shares held for you, as the beneficial owner, through a broker or other nominee, such as a bank. |

| |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| |

| A: | Most of our stockholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

| |

| Record Holder. If your shares are registered directly in your name on the books of SG Blocks maintained with SG Blocks’ transfer agent, American Stock Transfer & Trust Company, you are considered the “record holder” of those shares, and the proxy statement is sent directly to you by SG Blocks. As the stockholder of record, you have the right to grant a proxy to someone to vote your shares or to vote in person at the 2019 Special Meeting. To ensure your shares are voted at the 2019 Special Meeting, you are urged to provide your proxy instructions promptly online or by mailing your signed proxy card in the envelope provided. Please refer to the instructions on the proxy card. Authorizing your proxy will not limit your right to attend the 2019 Special Meeting and vote your shares in person. |

| |

| Beneficial Owner of Shares Held in Street Name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name (also called a “street name” holder), and the proxy statement is forwarded to you by your broker, bank or other nominee. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account. However, since you are not a stockholder of record, you may not vote these shares in person at the 2019 Special Meeting unless you bring with you a legal proxy from the stockholder of record. A legal proxy may be obtained from your broker, bank or nominee. |

| |

| If you hold your shares through a broker and you do not give instructions to the record holder on how to vote, the record holder will be entitled to vote your shares in its discretion on certain matters considered routine, such as the Reverse Stock Split, the Authorized Common Stock Increase and the Adjournment. |

| |

| Q: | Can I change my vote or revoke my proxy? |

| |

| A: | You may change your vote or revoke your proxy at any time before the final vote at the 2019 Special Meeting. To change your vote or revoke your proxy if you are the record holder, you may (1) notify our Corporate Secretary in writing at SG Blocks, Inc., 195 Montague Street, 14th Floor, Brooklyn, New York 11201; (2) submit a later-dated proxy (either by mail or internet), subject to the voting deadlines that are described on the proxy card or voting instruction form, as applicable; (3) deliver to our Corporate Secretary another duly executed proxy bearing a later date; or (4) by appearing at the 2019 Special Meeting in person and voting your shares. Attendance at the meeting will not, by itself, revoke a proxy unless you specifically so request. For shares you hold beneficially, you may change your vote by submitting new voting instructions to your broker or nominee or, if you have obtained a valid proxy from your broker or nominee giving you the right to vote your shares, by attending the 2019 Special Meeting and voting in person. |

| |

| Q: | Who can help answer my questions? |

| |

| A: | If you have any questions about the 2019 Special Meeting or how to vote or revoke your proxy, or you need additional copies of this proxy statement or voting materials, you should contact the Corporate Secretary, SG Blocks, Inc., at 195 Montague Street, 14th Floor, Brooklyn, New York 11201 or by phone at (646) 240-4235. |

| |

| Q: | How are votes counted? |

| |

| A: | With respect to Proposals 1 - 3, you may vote FOR, AGAINST, or ABSTAIN. |

| |

| If you provide specific instructions, your shares will be voted as you instruct. If you are a record holder and you sign your proxy card or voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board of Directors, namely (1)FOR the approval of the Reverse Stock Split at a ratio to be determined in the discretion of the Board of Directors within a range of one (1) share of common stock for every two (2) to fifty (50) shares of common stock; (2)FOR the approval of the Authorized Common Stock Increase of the number of authorized shares of common stock from 25,000,000 to 50,000,000; and (3)FOR the approval of the Adjournment. If any other matters properly arise at the meeting, your proxy, together with the other proxies received, will be voted at the discretion of the proxy holders. |

| |

| Q: | What is a quorum and why is it necessary? |

| |

| A: | Conducting business at the meeting requires a quorum. The presence, either in person or by proxy, of the holders of a majority of our shares of common stock issued and outstanding and entitled to vote on the record date present in person or represented by proxy is necessary to constitute a quorum. Abstentions are treated as present for purposes of determining whether a quorum exists. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the 2019 Special Meeting. Broker non-votes (which result when your shares are held in “street name”, and you do not tell the nominee how to vote your shares and the nominee does not have discretion to vote such shares or declines to exercise discretion) are treated as present for purposes of determining whether a quorum is present at the meeting. |

| |

| Q: | What is the voting requirement to approve each of the proposals? |

| |

| A: | To be approved, Proposal 1, which relates to the approval of the Reverse Stock Split within a range of one (1) share of common stock for every two (2) to fifty (50) shares of common stock, must receiveFOR votes from the holders of a majority of the issued and outstanding shares of common stock as of the record date. Accordingly, abstentions and broker non-votes with respect this proposal will have the same effect as votingAGAINSTthis proposal (although no broker non-votes are expected to exist in connection with Proposal 1 since this is a routine matter for which brokers have discretion to vote if beneficial owners do not provide voting instructions). |

| |

| To be approved, Proposal 2, which relates to the approval of the Authorized Common Stock Increase to increase the number of authorized shares of common stock from 25,000,000 to 50,000,000, must receiveFOR votes from the holders of a majority of the issued and outstanding shares of common stock as of the record date. Accordingly, abstentions and broker non-votes with respect this proposal will have the same effect as votingAGAINST this proposal (although no broker non-votes are expected to exist in connection with Proposal 2 since this is a routine matter for which brokers have discretion to vote if beneficial owners do not provide voting instructions). |

| To be approved, Proposal 3, which relates to the approval of the Adjournment of the 2019 Special Meeting, if the Board determines it to be necessary or appropriate to solicit additional proxies if there are insufficient votes in favor of the Reverse Stock Split and the Authorized Common Stock Increase, must receiveFOR votes from the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote at the 2019 Special Meeting. Abstentions will be included in the vote tally and will have the same effect as a voteAGAINST and broker non-votes will not affect the outcome of this proposal (although no broker non-votes are expected to exist in connection with Proposal 3 since this is a routine matter for which brokers have discretion to vote if beneficial owners do not provide voting instructions). |

| |

| If your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares on certain “routine” matters. The routine matters to be submitted to our stockholders at the 2019 Special Meeting are Proposals 1 and 2 and 3. |

| |

| We encourage you to voteFOR all three (3) proposals. |

| |

| Q: | What should I do if I receive more than one proxy statement? |

| |

| A: | You may receive more than one proxy statement. For example, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy statement. Please follow the voting instructions on all of the proxy statements to ensure that all of your shares are voted. |

| |

| Q: | Where can I find the voting results of the 2019 Special Meeting? |

| |

| A: | We intend to announce preliminary voting results at the 2019 Special Meeting and publish final results in a Current Report on Form 8-K, which we expect will be filed within four (4) business days of the 2019 Special Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the 2019 Special Meeting, we intend to file a Current Report on Form 8-K to publish results as to matters for which we have final votes and, within four (4) business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results. |

| |

| Q: | What happens if additional matters are presented at the 2019 Special Meeting? |

| |

| A: | Other than the three (3) items of business described in this proxy statement, we are not aware of any other business to be acted upon at the 2019 Special Meeting. If you grant a proxy, the persons named as proxy holders, Mr. Paul Galvin, our Chief Executive Officer, and Mr. Gerald Sheeran, our Acting Chief Financial Officer, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. |

| |

| Q: | How many shares are outstanding and how many votes is each share entitled? |

| |

| A: | Each share of our common stock that is issued and outstanding as of the close of business on November 18, 2019, the record date, is entitled to be voted on all items being voted on at the 2019 Special Meeting, with each share being entitled to one vote on each matter. As of the record date, November 18, 2019, 6,007,791 shares of common stock were issued and outstanding. |

| |

| Q: | Who will count the votes? |

| |

| A: | One or more inspectors of election will tabulate the votes. |

| |

| Q: | Is my vote confidential? |

| |

| A: | Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within SG Blocks or to anyone else, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; or (3) to facilitate a successful proxy solicitation. |

| |

| Q: | Who will bear the cost of soliciting votes for the 2019 Special Meeting? |

| |

| A: | The Board of Directors is making this solicitation on behalf of SG Blocks, which will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. Certain of our directors, officers, and employees, without any additional compensation, may also solicit your vote in person, by telephone, or by electronic communication. On request, we will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, telegram, facsimile and advertisement in periodicals and postings, in each case by our directors, officers and employees without additional compensation. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward solicitation materials to beneficial owners and will be reimbursed for their reasonable expenses incurred in so doing. We may request by telephone, facsimile, mail, electronic mail or other means of communication the return of the proxy cards. |

PROPOSAL 1

APPROVAL OF AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE ISSUED AND OUTSTANDING SHARES OF COMMON STOCK AT A RATIO TO BE DETERMINED IN THE DISCRETION OF THE BOARD OF DIRECTORS WITHIN A RANGE OF ONE (1) SHARE OF COMMON STOCK FOR EVERY TWO (2) TO FIFTY (50) SHARES OF COMMON STOCK

General

The Board of the Company’s named executive officers (Proposal 3), the optionDirectors has adopted, and is recommending that receives the most votes (a plurality) will be the option deemed chosen by the Company’s stockholders. Abstentions will not affect the outcome of the vote on Proposal 3.

The proposal toour stockholders approve, the 2014 Incentive Stock Plan (Proposal 4), requires the affirmative (“FOR”) vote of the majority of the votes cast for approval, provided that the affirmative votes cast must represent a majority of the shares present in person or represented by proxy at the Meeting and entitled to vote. Abstentions will have the same effect as a vote “AGAINST” the proposal. As anproposed amendment to the Company’s Amended and Restated Certificate of Incorporation (as set forth in Proposal 5 below) is necessary in order to have sufficient shares available for issuance under the 2014 Incentive Stock Plan, the approval of Proposal 4 is conditioned upon approval of Proposal 5.

The proposal to approve the amendment of the Company’s Amended andour Restated Certificate of Incorporation to increaseeffect a Reverse Stock Split of the issued and outstanding shares of common stock. Such amendment will be effected after stockholder approval thereof only in the event the Board of Directors still deems it advisable. Holders of the common stock are being asked to approve the proposal that Article Fourth our Restated Certificate of Incorporation be amended to effect a Reverse Stock Split of the common stock at a ratio to be determined in the discretion of the Board of Directors and publicly announced prior to the effectiveness of any Reverse Stock Split within the range of one (1) share of common stock for every two (2) to fifty (50) shares of common stock and also to decide whether or not to proceed to effect a Reverse Stock Split or instead to abandon the proposed amendment altogether. Pursuant to the laws of the State of Delaware, our state of incorporation, the Board of Directors must adopt any amendment to our Restated Certificate of Incorporation and submit the amendment to stockholders for their approval. The form of proposed amendment to effect the Reverse Stock Split is set forth in the certificate of amendment to our Restated Certificate of Incorporation attached asAppendix A to this proxy statement. If the Reverse Stock Split is approved by our stockholders and if a certificate of amendment is filed with the Secretary of State of the State of Delaware, the certificate of amendment to the Restated Certificate of Incorporation will effect the Reverse Stock Split by reducing the outstanding number of shares of common stock by the ratio to be determined by the Board of Directors and publicly announced prior to the effectiveness of any Reverse Stock Split. If the Board of Directors does not implement an approved Reverse Stock Split prior to the one-year anniversary of this meeting, the Board will seek stockholder approval before implementing any Reverse Stock Split after that time. The Board of Directors may abandon the proposed amendment to effect the Reverse Stock Split at any time prior to its effectiveness, whether before or after stockholder approval thereof.By approving this proposal, stockholders will approve the amendment to our Restated Certificate of Incorporation pursuant to which any whole number of outstanding shares, between and including two and fifty, would be combined into one share of common stock, and authorize the Board of Directors to file a certificate of amendment setting forth such amendment, as determined by the Board of Directors in the manner described herein. If approved, the Board of Directors may also elect not to effect any Reverse Stock Split and consequently not to file any certificate of amendment to the Restated Certificate of Incorporation. The Board of Directors believes that stockholder approval of an amendment granting the Board of Directors this discretion, rather than approval of a specified exchange ratio, provides the Board of Directors with maximum flexibility to react to then-current market conditions and, therefore, is in the best interests of our company and its stockholders. The Board of Directors’ decision as to whether and when to effect the Reverse Stock Split will be based on a number of factors, including market conditions, existing and expected trading prices for the common stock, and the continued listing requirements of the Nasdaq Capital Market (“Nasdaq”). Although our stockholders may approve the Reverse Stock Split, we will not effect the Reverse Stock Split if the Board of Directors does not deem it to be in our best interest and the best interest of our stockholders. The Reverse Stock Split, if authorized and if deemed by the Board of Directors to be in our best interest and the best interest of our stockholders, will be effected, if at all, at a time that is not later than one year from the date of the 2019 Special Meeting. The Board of Directors will publicly announce the ratio selected for the Reverse Stock Split prior to the effectiveness of any such Reverse Stock Split.

This Proposal 1, the proposed approval of the Reverse Stock Split as set forth in the certificate of amendment to our Restated Certificate of Incorporation, will not change the number of authorized shares of common stock from 100,000,000 shares to 300,000,000 shares (Proposal 5), requiresor preferred stock, or the affirmative (“FOR”) votepar value of a majority of the outstanding common stock entitledor preferred stock; however effecting the Reverse Stock Split will provide for additional shares of unissued authorized common stock. However, if Proposal 2 (the Authorized Common Stock Increase), is approved and the Board of Directors determined to vote oneffect the amendment for approval. Abstentions will haveAuthorized Common Stock Increase and not abandon the same effect as a vote “AGAINST”Authorized Common Stock Increase, the proposal.

To ratify the appointment of Marcum LLP as our independent registered public accounting firm for fiscal 2014 (Proposal 6), the affirmative (“FOR”) vote of the majority of the votes cast is required, provided that the affirmative votes cast must represent a majority of the shares present in person or represented by proxy at the Meeting and entitled to vote. Abstentions will have the same effect as a vote “AGAINST” the proposal.

Please note that the rules that determine how your broker can vote your shares have changed. Brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote. You must provide your broker with voting instructions so that your vote will be counted.

Brokers that do not receive instructions from the beneficial ownersauthorized number of shares of

Commoncommon stock will be increased. As of the date of this proxy statement, our current authorized number of shares of common stock is sufficient to satisfy all of our share issuance obligations and current share plans and we do not have any current plans, arrangements or understandings relating to the issuance of the additional shares of authorized common stock that will become available following the Reverse Stock

being voted areSplit.Purpose and Background of the Reverse Stock Split

On July 1, 2019, we received written notice from the Nasdaq Stock market LLC (Nasdaq) that we were not entitled to vote on any proposal at the Meeting other than to ratify the appointment of Marcum LLPin compliance with Nasdaq Listing rule 5550(a)(2) as the Company’s independent accountants (Proposal 6). Broker non-votes will have nobid price of our common stock had closed below the required $1.00 per share for 30 consecutive trading days. In accordance with Nasdaq’s Listing Rule 5810(c)(3)(A), we were given a period of 180 calendar days, or until December 30, 2019, to regain compliance with the requirement. We may be eligible for an additional 180-day extension from Nasdaq.

The Board of Directors has considered the potential harm to us of a delisting of the common stock and has determined that, if the common stock continues to close below $1.00 per share bid price, the consummation of the Reverse Stock Split is the best way to maintain liquidity by achieving compliance with the Nasdaq requirements.

The Board of Directors also believes that the current low per share market price of the common stock has a negative effect on the outcomemarketability of our existing shares. The Board of Directors believes there are several reasons for this effect. First, certain institutional investors have internal policies preventing the purchase of low-priced stocks. Second, a variety of policies and practices of broker-dealers discourage individual brokers within those firms from dealing in low-priced stocks. Third, because the brokers’ commissions on low-priced stocks generally represent a higher percentage of the electionstock price than commissions on higher priced stocks, the current share price of directors (Proposal 1),the common stock can result in individual stockholders paying transaction costs (commissions, markups or markdowns) that are a higher percentage of their total share value than would be the case if the share price of the common stock were substantially higher. This factor is also believed to limit the willingness of some institutions to purchase the common stock. The Board of Directors anticipates that a Reverse Stock Split will result in a higher bid price for the common stock, which may help to alleviate some of these problems. The Board of Directors further believes that some potential employees are less likely to work for us if we have a low stock price or are no longer Nasdaq listed, regardless of size of our overall market capitalization.

We expect that, if effected, a Reverse Stock Split of the common stock will increase the market price of the common stock so that we are able to maintain compliance with the Nasdaq minimum bid price listing standard. However, the effect of a Reverse Stock Split on the market price of the common stock cannot be predicted with any certainty, and the history of similar stock split combinations for companies in like circumstances is varied. It is possible that the per share price of the common stock after the Reverse Stock Split will not rise in proportion to the reduction in the number of shares of the common stock outstanding resulting from the Reverse Stock Split, effectively reducing our market capitalization, and there can be no assurance that the market price per post-reverse split share will either exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time. The market price of the common stock may vary based on other factors that are unrelated to the number of shares outstanding, including our future performance.

PLEASE NOTE THAT UNLESS SPECIFICALLY INDICATED TO THE CONTRARY, THE DATA CONTAINED IN THIS PROXY STATEMENT, INCLUDING BUT NOT LIMITED TO SHARE NUMBERS, CONVERSION PRICES AND EXERCISE PRICES OF OPTIONS AND WARRANTS, DOES NOT REFLECT THE IMPACT OF THE REVERSE STOCK SPLIT THAT MAY BE EFFECTUATED.

Board Discretion to Implement the Reverse Stock Split

If Proposal No. 1 is approved by the stockholders and the Board determines to effect the Reverse Stock Split, it will consider certain factors in selecting the specific stock split ratio, including prevailing market conditions, the trading price of the common stock and the steps that we will need to take in order to achieve compliance with the bid price requirement and other listing regulations of the Nasdaq. Based in part on the price of the common stock on the days leading up to the filing of the certificate of amendment to the Restated Certificate of Incorporation effecting the Reverse Stock Split, the Board of Directors will determine the ratio of the Reverse Stock Split, in the range of 1:2 to 1:50, that, in the judgment of the Board of Directors is the reverse split ratio most likely to allow us to achieve and maintain compliance with the minimum $1.00 per share bid price requirement for listing on the Nasdaq for the longest period of time, while retaining a sufficient number of outstanding, tradeable shares to facilitate an adequate market. The Board of Directors will publicly announce the ratio selected for the Reverse Stock Split prior to the effectiveness of the Reverse Stock Split within the limits set forth in Proposal No. 1.

Notwithstanding approval of the non-binding advisory resolutionReverse Stock Split by the stockholders, the Board of Directors may, in its sole discretion, abandon the proposed amendment and determine prior to approve the compensationeffectiveness of any filing with the Secretary of State of the Company’s named executive officers (Proposal 2), approvalState of a non-binding advisory resolutionDelaware not to determineeffect the frequency with which stockholdersReverse Stock Split prior to the one year anniversary of the Company will be entitled to have an advisory vote on the compensation2019 Special Meeting of stockholders, as permitted under Section 242(c) of the Company’s named executive officers (Proposal 3); orDGCL. If the Board fails to implement the amendment prior to the one-year anniversary of this meeting of stockholders, stockholder approval of the 2014 Incentivewould again be required prior to implementing any Reverse Stock Plan (Proposal 4). Broker non-votesSplit.

Consequences if Stockholder Approval for Proposal Is Not Obtained

If stockholder approval for Proposal No. 1 is not obtained, we will not be consideredable to file a vote cast, but will be considered a vote againstcertificate of amendment to the amendment of the Company’s Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split. If stockholder approval of the Reverse Stock Split is not obtained at the 2019 Special Meeting and we should fail to satisfy the Nasdaq minimum bid price, we will continue to seek stockholder approval of a reverse stock split in order to regain compliance within the time period granted by Nasdaq to regain compliance. If compliance is not achieved by the expiration of period of time we are granted to regain compliance with the Nasdaq requirement, then our stock would be delisted from the Nasdaq. If we were unable to regain compliance during any such period, the common stock would likely be transferred to the OTC Bulletin Board or OTC Market.

If we fail to meet all applicable Nasdaq requirements and Nasdaq determines to delist the common stock, the delisting could adversely affect the market liquidity of the common stock and the market price of the common stock could decrease. Delisting could also adversely affect our ability to obtain financing for the continuation of our operations and/or result in the loss of confidence by investors, suppliers, commercial partners and employees. In addition, the limited number of authorized shares of the common stock that are neither outstanding nor reserved for issuance could adversely affect our ability to raise capital through equity financings.

Principal Effects of the Reverse Stock Split

If the stockholders approve the proposal to authorize the Board of Directors to implement the Reverse Stock Split and the Board of Directors determines to implement the Reverse Stock Split, we will publicly announce the selected ratio for the Reverse Stock Split and file the certificate of amendment to amend the existing provision of our Restated Certificate of Incorporation to effect the Reverse Stock Split. The text of the form of proposed amendment is set forth in the certificate of amendment to the Restated Certificate of Incorporation is annexed to this proxy statement asAppendix A.

The Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of common stock and the stock split ratio will be the same for all issued and outstanding shares of common stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in our company, except that stockholders who would have otherwise received fractional shares will receive cash in lieu of such fractional shares. After the Reverse Stock Split, the shares of the common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the common stock now authorized, common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse Stock Split will not affect us continuing to be subject to the periodic reporting requirements of the Exchange Act. The Reverse Stock Split is not intended to be, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act.

The Reverse Stock Split may result in some stockholders owning “odd-lots” of less than 100 shares of the common stock. Brokerage commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of 100 shares. In addition, we will not issue fractional shares in connection with the Reverse Stock Split, and stockholders who would have otherwise been entitled to receive such fractional shares will receive an amount in cash determined in the manner set forth below under the heading “Fractional Shares.”

Following the effectiveness of any Reverse Stock Split approved by the stockholders and implementation by the Board of Directors, current stockholders will hold fewer shares of common stock, with such number of shares dependent on the specific ratio for the Reverse Stock Split. For example, if the Board approves of a 1-for-5 Reverse Stock Split, a stockholder owning a “round-lot” of 100 shares of common stock prior to the Reverse Stock Split would hold 20 shares of common stock following the Reverse Stock Split. THE HIGHER THE REVERSE RATIO (1-FOR-5 BEING HIGHER THAN 1-FOR-2, FOR EXAMPLE), THE GREATER THE REDUCTION OF RELATED SHARES EACH EXISTING STOCKHOLDER, POST REVERSE STOCK SPLIT, WILL EXPERIENCE.

IF THIS PROPOSAL IS NOT APPROVED, WE MAY BE UNABLE TO MAINTAIN THE LISTING OF THE COMMON STOCK ON THE NASDAQ, WHICH COULD ADVERSELY AFFECT THE LIQUIDITY AND MARKETABILITY OF THE COMMON STOCK.

Risks Associated with the Reverse Stock Split

There are risks associated with the Reverse Stock Split, including that the Reverse Stock Split may not result in a sustained increase in the per share price of our common stock. There is no assurance that:

| ● | the market price per share of our common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split; |

| ● | the Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; |

| ● | the Reverse Stock Split will result in a per share price that will increase our ability to attract and retain employees and other service providers; |

| ● | the liquidity of the common stock will increase; and |

| ● | the closing bid price per share will either exceed or remain in excess of the $1.00 minimum bid price as required by Nasdaq, or that we will otherwise meet the requirements of Nasdaq for continued inclusion for trading on the Nasdaq. |

Stockholders should note that the effect of the Reverse Stock Split, if any, upon the market price for our common stock cannot be accurately predicted. In particular, we cannot assure you that prices for shares of our common stock after the Reverse Stock Split will be two (2) to fifty (50) times, as applicable, the prices for shares of our common stock immediately prior to the Reverse Stock Split. Furthermore, even if the market price of our common stock does rise following the Reverse Stock Split, we cannot assure you that the market price of the common stock immediately after the proposed Reverse Stock Split will be maintained for any period of time. Even if an increased per-share price can be maintained, the Reverse Stock Split may not achieve the desired results that have been outlined above. Moreover, because some investors may view the Reverse Stock Split negatively, we cannot assure you that the Reverse Stock Split will not adversely impact the market price of the common stock.

The market price of the common stock will also be based on our performance and other factors, some of which are unrelated to the Reverse Stock Split or the number of shares outstanding. If the Reverse Stock Split is effected and the market price of the common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. The total market capitalization of the common stock after implementation of the Reverse Stock Split when and if implemented may also be lower than the total market capitalization before the Reverse Stock Split. Furthermore, the liquidity of the common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

While we aim that the Reverse Stock Split will be sufficient to maintain our listing on Nasdaq, it is possible that, even if the Reverse Stock Split results in a bid price for the common stock that exceeds $1.00 per share another reverse split may be necessary in the future and we may not be able to continue to satisfy the other criteria for continued listing of the common stock on Nasdaq.

We believe that the Reverse Stock Split may result in greater liquidity for our stockholders. However, it is also possible that such liquidity could be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split, particularly if the share price does not increase as a result of the Reverse Stock Split.

Potential Anti-takeover Effects of a Reverse Stock Split

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any action, including the proposals discussed herein, that may be used as an anti-takeover mechanism. The Reverse Stock Split, if effected, will also result in a relative increase in the number of authorized but unissued shares of our common stock vis-à-vis the outstanding shares of our common stock and, could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or intent of the Board of Directors. A relative increase in the number of authorized shares of common stock from 100,000,000could have other effects on our stockholders, depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. A relative increase in our authorized shares could potentially deter takeovers, including takeovers that the Board of Directors has determined are not in the best interest of our stockholders, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover more difficult. For example, we could issue additional shares so as to dilute the stock ownership or voting rights of persons seeking to obtain control without our agreement. Similarly, the issuance of additional shares to 300,000,000 shares (Proposal 5).

Proxies

certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The

Board requests your proxy. GivingReverse Stock Split therefore may have the

Board your proxy means you authorize iteffect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the Reverse Stock Split may limit the opportunity for our stockholders to

vote yourdispose of their shares at the

Meetinghigher price generally available in takeover attempts or that may be available under a merger proposal.Although the Reverse Stock Split has been prompted by business and financial considerations and not by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that the effect of the Reverse Stock Split could facilitate future attempts by us to oppose changes in control and perpetuate our management, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices. We cannot provide assurances that any such transactions will be consummated on favorable terms or at all, that they will enhance stockholder value, or that they will not adversely affect our business or the trading price of the common stock.

Common Stock

After the effective date of the Reverse Stock Split, each stockholder will own fewer shares of the common stock.

Accordingly, a Reverse Stock Split would result in a significant increase in the manner you direct. You may vote “FOR” all, somenumber of authorized and unissued shares of common stock. Because our stockholders have no preemptive rights to purchase or nonesubscribe for any of the director nominees. Youunissued common stock, the future issuance of additional shares of common stock will reduce our current stockholders’ percentage ownership interest in the total outstanding shares of common stock. In the absence of a proportionate increase in our future earnings and book value, an increase in the number of our outstanding shares of common stock would dilute our projected future earnings per share, if any, and book value per share of all our outstanding shares of the common stock. If these factors were reflected in the price per share of our common stock, the potential realizable value of a stockholder’s investment could be adversely affected. An issuance of additional shares could therefore have an adverse effect on the potential realizable value of a stockholder’s investment. As of the date of this filing, SG Blocks does not have any definitive plans, proposals or arrangements to issue any of the newly available authorized shares and unissued shares that result from the Reverse Stock Split for any purpose as its current authorized number of shares of common stock is sufficient for any issuances currently planned or any current issuance obligations.

The following table sets forth the approximate number of shares of the common stock that would be outstanding immediately after the Reverse Stock Split based on the current authorized number of shares of common stock at various exchange ratios, based on 6,007,791 shares of common stock actually outstanding as of November 18, 2019. The table does not account for fractional shares that will be paid in cash.

| | Approximate Shares of Common Stock |

| | Outstanding After Reverse Stock Split |

| | Based on Current Authorized |

| Ratio of Reverse Stock Split | | Number of Shares |

| | |

| None | | — |

| 1:2 | | 3,003,895 |

| 1:10 | | 600,779 |

| 1:20 | | 300,389 |

| 1:30 | | 200,259 |

| 1:40 | | 150,194 |

| 1:50 | | 120,155 |

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates, if Applicable

If the certificate of amendment is approved by the stockholders, and if at such time the Board of Directors still believes that a Reverse Stock Split is in our best interests and the best interests of our stockholders, the Board of Directors will determine the ratio, within the range approved by SG Blocks’ stockholders, of the Reverse Stock Split to be implemented and will publicly announce the selected ratio for the Reverse Stock Split prior to the effectiveness of the Reverse Stock Split. We will file the certificate of amendment with the Secretary of State of the State of Delaware at such time as the Board of Directors has determined the appropriate effective time for the Reverse Stock Split. The Board of Directors may delay effecting the Reverse Stock Split without re-soliciting stockholder approval. The Reverse Stock Split will become effective on the effective date set forth in the certificate of amendment. Beginning on the effective date of the Reverse Stock Split, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

As soon as practicable after the effective date of the Reverse Stock Split, stockholders will be notified that the Reverse Stock Split has been effected. If you hold shares of common stock in a book-entry form, you will receive a transmittal letter from our transfer agent as soon as practicable after the effective time of the Reverse Stock Split with instructions. After you submit your completed transmittal letter, if you are entitled to post-split shares of the common stock, a transaction statement will be sent to your address of record as soon as practicable after the effective date of the split indicating the number of shares of the common stock you hold.

Some stockholders hold their shares of common stock in certificate form or a combination of certificate and book-entry form. We expect that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates, if applicable. If you are a stockholder holding pre-split shares in certificate form, you will receive a transmittal letter from our transfer agent as soon as practicable after the effective time of the Reverse Stock Split. The transmittal letter will be accompanied by instructions specifying how you can exchange your certificate representing the pre-split shares of the common stock for a statement of holding. When you submit your certificate representing the pre-split shares of the common stock, your post-split shares of the common stock will be held electronically in book-entry form in the Direct Registration System. This means that, instead of receiving a new stock certificate, you will receive a statement of holding that indicates the number of post-split shares you own in book-entry form. We will no longer issue physical stock certificates unless you make a specific request for a share certificate representing your post-split ownership interest.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Beginning on the effective time of the Reverse Stock Split, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to receive fractional shares will, upon surrender to the exchange agent of certificates representing their fractional shares, be entitled to receive cash in an amount equal to the product obtained by multiplying (i) the average of the closing sales prices of the common stock as reported on the Nasdaq on the ten days preceding the effective date of the amendment to the Certificate of Incorporation by (ii) the number of shares of the common stock held by such stockholder before the Reverse Stock Split that would otherwise have been exchanged for such fractional share interest. Holders of as many as 49 shares (if we were to implement a 1:50 Reverse Stock Split) of the common stock would be eliminated as a result of the cash payment in lieu of any issuance of fractional shares or interests in connection with the Reverse Stock Split. The exact number by which the number of holders of the common stock would be reduced will depend on the Reverse Stock Split ratio adopted and the number of stockholders that hold less than the Reverse Stock Split ratio as of the effective date of the Reverse Stock Split.

Effect of the Reverse Stock Split on Outstanding Stock Options and Warrants

Based upon the Reverse Stock Split ratio, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise of all outstanding options and warrants. This would result in approximately the same aggregate price being required to be paid under such options or warrants upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares reserved for issuance pursuant to these securities will be reduced proportionately based upon the Reverse Stock Split ratio.

Accounting Matters

The Reverse Stock Split will not affect the common stock capital account on our balance sheet. However, because the par value of the common stock will remain unchanged on the effective date of the split, the components that make up the common stock capital account will change by offsetting amounts. Depending on the size of the Reverse Stock Split the Board of Directors decides to implement, the stated capital component will be reduced to an amount between one-half (1/2) and one-fiftieth (1/50) of its present amount, and the additional paid-in capital component will be increased with the amount by which the stated capital is reduced. The per share net income or loss and net book value of the common stock will be increased because there will be fewer shares of common stock outstanding. Prior periods per share amounts will be restated to reflect the Reverse Stock Split.

Material United States Federal Income Tax Consequences of the Reverse Stock Split

The following discussion describes the anticipated material United States Federal income tax consequences to “U.S. holders” (as defined below) of Company capital stock relating to the Reverse Stock Split. This discussion is based upon the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations, judicial authorities, published positions of the Internal Revenue Service (“IRS”), and other applicable authorities, all as currently in effect and all of which are subject to change or differing interpretations (possibly with retroactive effect). We have not obtained a ruling from the IRS or an opinion of legal or tax counsel with respect to the tax consequences of the Reverse Stock Split. The following discussion is for information purposes only and is not intended as tax or legal advice. Each holder should seek advice based on the holder’s particular circumstances from an independent tax advisor.

For purposes of this discussion, the term “U.S. holder” means a beneficial owner of our capital stock that is for United States Federal income tax purposes:

| (i) | an individual citizen or resident of the United States; |

| (ii) | a corporation (or other entity treated as a corporation for U.S. Federal income tax purposes) organized under the laws of the United States, any state, or the District of Columbia; |

| (iii) | an estate with income subject to United States Federal income tax regardless of its source; or |

| (iv) | a trust that (a) is subject to primary supervision by a United States court and for which United States persons control all substantial decisions or (b) has a valid election in effect under applicable Treasury Regulations to be treated as a United States person. |

This discussion assumes that a U.S. holder holds our capital stock as a capital asset within the meaning of Code Section 1221. This discussion does not address all of the tax consequences that may be relevant to a particular stockholder or to stockholders that are subject to special treatment under United States Federal income tax laws including, but not limited to, financial institutions, tax-exempt organizations, insurance companies, regulated investment companies, real estate investment trusts, entities disregarded from their owners for tax purposes, persons that are broker-dealers, traders in securities who elect the mark-to-market method of accounting for their securities, or stockholders holding their shares of capital stock as part of a “straddle,” “hedge,” “conversion transaction,” or other integrated transaction, or persons who hold their capital stock through individual retirement or other tax-deferred accounts. This discussion also does not address the tax consequences to us, or to our stockholders that own 5% or more of our capital stock, are affiliates of SG Blocks, or are not U.S. holders. In addition, this discussion does not address other United States Federal taxes (such as gift or estate taxes or alternative minimum taxes), the tax consequences of the Reverse Stock Split under state, local, or foreign tax laws or certain tax reporting requirements that may be applicable with respect to the Reverse Stock Split. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences set forth below.

If a partnership (or other entity treated as a partnership for United States Federal income tax purposes) is a SG Blocks stockholder, the tax treatment of a partner in the partnership, or any equity owner of such other entity will generally depend upon the status of the person and the activities of the partnership or other entity treated as a partnership for United States Federal income tax purposes.

Tax Consequences of the Reverse Stock Split Generally

We believe that the Reverse Stock Split will qualify as a “reorganization” under Section 368(a)(1)(E) of the Code. Accordingly, provided that the fair market value of the post-Reverse Stock Split shares is equal to the fair market value of the pre-Reverse Stock Split shares surrendered in the Reverse Stock Split:

| ● | A U.S. holder will not recognize any gain or loss as a result of the Reverse Stock Split other than cash payments if any, received by a stockholder in lieu of fractional shares as discussed below. |

| ● | A U.S. holder’s aggregate tax basis in his, her, or its post-Reverse Stock Split shares will be equal to the aggregate tax basis in the pre-Reverse Stock Split shares exchanged therefor, less any basis attributable to fractional share interests. |

| ● | A U.S. holder’s holding period for the post-Reverse Stock Split shares will include the period during which such stockholder held the pre-Reverse Stock Split shares surrendered in the Reverse Stock Split. |

| ● | For purposes of the above discussion of the basis and holding periods for shares of SG Blocks capital stock, and except as provided therein, holders who acquired different blocks of SG Blocks capital stock at different times for different prices must calculate their basis and holding periods separately for each identifiable block of such stock exchanged, converted, canceled or received in the Reverse Stock Split. |

| ● | Stockholders who receive cash in lieu of fractional share interests as a result of the Reverse Stock Split will be treated as having received the fractional shares pursuant to the Reverse Stock Split and then as having exchanged the fractional shares for cash in a redemption by SG Blocks, and will generally recognize gain or loss equal to the difference between the amount of cash received in lieu of a fractional share and their adjusted basis allocable to the fractional share interests redeemed. Such gain or loss will be long term capital gain or loss if the shares held prior to the Reverse Stock Split were held for more than one year. The stockholder’s holding period for the shares issued after the Reverse Stock Split will include the period during which the stockholder held the shares surrendered in the Reverse Stock Split. |

Vote Required to Approve Amendment of our Restated Certificate of Incorporation

Approval of the Reverse Stock Split as set forth in the certificate of amendment to our Restated Certificate of Incorporation included asAppendix A, requires an affirmative vote of a majority of the common stock outstanding entitled to vote at the 2019 Special Meeting as of the record date. Abstentions and broker non-votes will have the same effect as “against” votes. Approval by our stockholders of the Reverse Stock Split is not conditioned upon approval by our stockholders of the Authorized Common Stock Increase; conversely, approval by our stockholder of the Authorized Common Stock Increase is not conditioned upon approval by our stockholders of the Reverse Stock Split.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO TO BE DETERMINED IN THE DISCRETION OF THE BOARD OF DIRECTORS IN THE RANGE OF ONE (1) SHARE OF COMMON STOCK FOR EVERY TWO (2) TO FIFTY (50) SHARES OF COMMON STOCK, AND PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED IN FAVOR OF THE AMENDMENT UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THE PROXY.

PROPOSAL 2

APPROVAL OF AMENDMENT (IN THE EVENT IT IS DEEMED BY THE BOARD TO BE ADVISABLE) TO OUR RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 25,000,000 to 50,000,000

The Board of Directors has adopted a resolution approving and recommending to our stockholders for their approval, a proposed amendment to our Restated Certificate of Incorporation to effect an increase in the number of shares of our authorized common stock from the 25,000,000 shares that are currently authorized for issuance pursuant to our Restated Certificate of Incorporation to a total of 50,000,000 shares of common stock. Such amendment will be effected after stockholder approval thereof only in the event the Board of Directors still deems it advisable.

The text of the form of the proposed amendment to the Restated Certificate of Incorporation to implement Proposal 2 is set forth in the certificate of amendment annexed to this proxy statement asAppendix B. Assuming the stockholders approve the proposal and the Board of Directors deems it advisable, the Authorized Common Stock Increase will be effected upon the filing of the certificate of amendment to the Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. The Board of Directors will implement the Authorized Common Stock Increase at such time, if ever, if and when it is deemed by the Board to be advisable. The Board of Directors will also have the discretion to abandon the Authorized Common Stock Increase in authorized shares if the Board of Directors does not believe it to be in the best interests of SG Blocks and our stockholders. If the Board of Directors does not implement an approved Authorized Common Stock Increase prior to the one-year anniversary of the 2019 Special Meeting, the Board of Directors will seek stockholder approval before implementing any authorized Common Stock Increase after that time.

The Board of Directors proposes and recommends increasing the number of shares of our authorized common stock from the 25,000,000 shares that are currently authorized for issuance pursuant to our Restated Certificate of Incorporation to a total of 50,000,000 shares of common stock. Of our 25,000,000 shares of currently authorized common stock, 6,007,791 shares were outstanding as of November 18, 2019, and after taking into account shares underlying outstanding warrants, restricted stock units and outstanding options approximately 16,310,623 of the 25,000,000 shares authorized in our Restated Certificate of Incorporation would be available for issuance.

The Board of Directors currently believes that the Authorized Common Stock Increase is advisable and in our best interest and the best interest of our stockholders. The Increase will provide us with flexibility in completing financing and capital raising transactions, which may be necessary for us to execute our future business plans. Other possible business and financial uses for the additional shares of common stock include, without limitation, attracting and retaining employees by the issuance of additional securities, and other transactions and corporate purposes that the Board of Directors may deem are in our best interest. We could also use the additional shares of common stock for potential strategic transactions, including, among other things, acquisitions, strategic partnerships, joint ventures, restructurings, business combinations and investments. We believe that the additional authorized shares would enable us to act quickly in response to opportunities that may arise for these types of transactions, in most cases without the necessity of obtaining further stockholder approval and holding a special stockholders’ meeting before such issuance(s) could proceed, except as provided under Delaware law, as applicable, or under applicable Nasdaq rules. As of the date of this Proxy Statement, we have no definite plans, proposals or arrangements regarding the newly authorized shares that would be authorized. However, we review and evaluate potential capital raising activities, transactions and other corporate actions on an ongoing basis to determine if such actions would be in our best interest and the best interest of our stockholders. We cannot provide assurances that any such transactions will be consummated on favorable terms or at all, that they will enhance stockholder value, or that they will not adversely affect our business or the trading price of the common stock.

If approved, the Board of Directors may also vote “FOR”elect not to effect the Authorized Common Stock Increase and consequently not to file any certificate of amendment to the Restated Certificate of Incorporation. If the Board of Directors fails to implement the certificate of amendment prior to the one-year anniversary of the 2019 Special Meeting of stockholders, stockholder approval would again be required prior to implementing the Authorized Common Stock Increase. Although approval by our stockholders of the Reverse Stock Split is not conditioned upon approval by our stockholders of the Authorized Common Stock Increase; conversely, approval by our stockholder of the Authorized Common Stock Increase is not conditioned upon approval by our stockholders of the Reverse Stock Split, if the stockholders should approve the Reverse Stock Split and the Board of Directors should implement the Reverse Stock Split, the number of shares of common stock authorized but unissued after implementing the Reverse Stock Split may impact the decision as to whether or “AGAINST”not to effect the Authorized Common Stock Increase since effecting the Reverse Stock Split will provide for additional shares of unissued authorized common stock.

The Authorized Common Stock Increase would not have any immediate dilutive effect on the proportionate voting power or other proposalrights of existing stockholders.

As is true for shares presently authorized but unissued, the future issuance of common stock authorized by the Authorized Common Stock Increase may, among other things, decrease existing stockholders’ percentage equity ownership, could be dilutive to the voting rights of existing stockholders and, depending on the price at which they are issued could have a negative effect on the market price of the common stock. In addition, an increase in the number of shares of our authorized common stock could result in an increase in the franchise tax that we would owe to the State of Delaware.

Potential Anti-takeover Effects of the Authorized Common Stock Increase

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any action, including the proposals discussed herein, that may be used as an anti-takeover mechanism. Since the amendment to our Restated Certificate of Incorporation will provide that the number of authorized shares of common stock will be 50,000,000, the Authorized Common Stock Increase, if effected, will result in an increase in the number of authorized but unissued shares of our common stock which could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or “ABSTAIN” from voting.

A formintent of

proxy is enclosedthe Board of Directors. An increase in the number of authorized shares of common stock could have other effects on our stockholders, depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. An increase in our authorized shares could potentially deter takeovers, including takeovers that

designatesthe Board of Directors has determined are not in the best interest of our stockholders, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover more difficult. For example, we could issue additional shares so as to dilute the stock ownership or voting rights of persons

named therein as proxiesseeking to

voteobtain control without our agreement. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The Authorized Common Stock Increase therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the Authorized Common Stock Increase may limit the opportunity for our stockholders to dispose of their shares at the

higher price generally available in takeover attempts or that may be available under a merger proposal.We have not proposed the Authorized Common Stock Increase with the intention of using the additional authorized shares for anti-takeover purposes, but we would be able to use the additional shares to oppose a hostile takeover attempt or delay or prevent changes in control or management of SG Blocks. For example, without further stockholder approval, the Board of Directors could authorize the sale of shares of common stock in a private transaction to purchasers who would oppose a takeover or favor our current Board of Directors. Although the Authorized Common Stock Increase has been prompted by business and financial considerations and not by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that the effect of the Authorized Common Stock Increase could facilitate future attempts by us to oppose changes in control of our Company and perpetuate our management, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices. We cannot provide assurances that any such transactions will be consummated on favorable terms or at all, that they will enhance stockholder value, or that they will not adversely affect our business or the trading price of the common stock.

Vote Required to Approve Amendment of our Restated Certificate of Incorporation

Approval of the amendment to our Restated Certificate of Incorporation included as set forth in the certificate of amendment attached asAppendix B requires an affirmative vote of a majority of the shares of common stock outstanding as of the record date. Abstentions and broker non-votes (to the extent a broker does not exercise its authority to vote, although we do not expect any broker non-votes since this is a routine matter for which brokers have discretion to vote if beneficial owners do not provide voting instructions) will have the same effect as “AGAINST” votes. Approval by our stockholders of the Reverse Stock Split is not conditioned upon approval by our stockholders of the Authorized Common Stock Increase; conversely, approval by our stockholder of the Authorized Common Stock Increase is not conditioned upon approval by our stockholders of the Reverse Stock Split; however, if the stockholders should approve the Reverse Stock Split and the Board of Directors should implement the Reverse Stock Split, the number of shares of common stock authorized but unissued after implementing the Reverse Stock Split may impact the decision as to whether or not to effect the Authorized Common Stock Increase since effecting the Reverse Stock Split will provide for additional shares of unissued authorized common stock.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR APPROVAL OF THE AUTHORIZED COMMON STOCK INCREASE.

PROPOSAL 3

ADJOURNMENT OF THE SPECIAL MEETING OF STOCKHOLDERS, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES IN FAVOR OF PROPOSAL 1 OR PROPOSAL 2

Adjournment to Solicit Additional Proxies

If we fail to receive a sufficient number of votes to approve any of Proposal 1 (an amendment to the Restated Certificate of Incorporation to effect the Reverse Stock Split), and/or Proposal 2 (an amendment to the Restated Certificate of Incorporation to effect the Authorized Common Stock Increase) we may propose to adjourn the 2019 Special Meeting, if the Board of Directors determines it to be necessary or appropriate for the purpose of soliciting additional proxies to approve Proposal 1 and/or Proposal 2. We currently do not intend to propose adjournment of the 2019 Special Meeting, if there are sufficient votes in favor of each of Proposal 1 and Proposal 2. If our stockholders approve this proposal, we could adjourn the 2019 Special Meeting and any adjourned session of the 2019 Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from our stockholders that have previously voted. Among other things, approval of this proposal could mean that, even if we had received proxies representing a sufficient number of votes to defeat Proposal 1 and Proposal 2, we could adjourn the 2019 Special Meeting without a vote on such proposal and seek to convince our stockholders to change their votes in favor of such proposal.

If it is necessary or appropriate (as determined in good faith by the Board of Directors) to adjourn the 2019 Special Meeting, no notice of the adjourned meeting is required to be given to our stockholders under Delaware law, other than an announcement at the 2019 Special Meeting of the time and place to which the 2019 Special Meeting is adjourned, so long as the meeting is adjourned for 30 days or less and no new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any business which might have been transacted at the original meeting.

Required Vote

Approval of the Adjournment requires an affirmative vote of a majority of the votes cast at the 2019 Special Meeting. Each proxy inAbstentions and broker non-votes are not votes cast and therefore will not affect the outcome of this proposal.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 3 THE ADJOURNMENT OF THE 2019 SPECIAL MEETING, IF THE BOARD DETERMINES IT TO BE NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF PROPOSAL 1 AND/OR PROPOSAL 2.

OTHER MATTERS